A handful of major health and nutrition trends are having a notable impact on consumer food choices, particularly in developed parts of the world, where health-consciousness and environmental awareness are on the rise. Stemming from an existing, predominant trend toward more healthful eating for improved well-being and longevity, additional related trends have emerged in recent years. These newer movements toward more plant-based eating patterns, elevation of dietary protein as a sought-after nutrient, and increased interest in “free-from” foods are affecting consumer beliefs, attitudes, and behaviors toward grains and cereals. The majority of these trends portend more positive sentiments toward, and increased demand for, grain- and cereal-based foods, particularly ancient and whole grains. In this article, some of the most significant global health and nutrition trends and the underlying forces shaping them are explored in the context of their expected effects on consumer consumption of cereals and grains.

Eating for Wellness: An Overarching Trend

In 2018, Euromonitor International named “healthy living” as the most impactful of eight megatrends influencing the food industry (5). It described this trend as encompassing the growing preference of consumers for minimally processed, closer-to-nature foods as they orient their lives around the pursuit of health and wellness. Individuals increasingly believe that foods with simple ingredients inherently offer natural, functional benefits for general health and well-being. Naturally nutrient-rich whole or minimally refined grains and cereals, which typically contain vitamins, minerals, and fiber, fit well within natural foods-based diets designed to achieve more optimal health outcomes. A 2018 New Nutrition Business survey found that 61% of respondents from the United Kingdom, Australia, Spain, Brazil, and the United States recognized that whole grain foods are good for digestive health (3). Caroline Sluyter, program director at the Whole Grains Council, in e-mail correspondence with the authors, noted that organizational influence is also driving interest in whole grains, stating “Worldwide momentum toward whole grains has been growing steadily over the last decade, with much of the demand being driven by consumers seeking healthier options, and by governments and NGOs advocating for diets that would reduce the burden of chronic disease, thereby promoting longer, healthier, happier lives.”

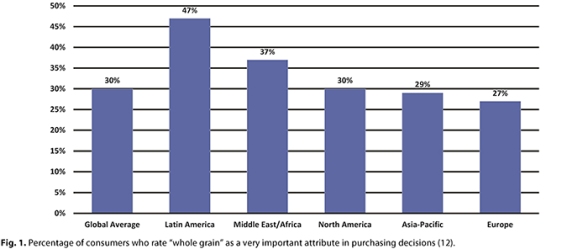

Consumers around the world are seeking out certain ingredients, attributes, and claims, while avoiding others, when making food purchasing decisions to ensure their choices align with their health and nutrition values. A Nielsen study of 30,000 consumers in 60 countries found that 3 in 10 consumers, on average, are seeking foods that contain whole grains, with some variation in that percentage based on region (Fig. 1) (12). Another Nielsen survey of a similar number of respondents from different countries found that a strong majority of those surveyed are avoiding artificial ingredients in their foods, including artificial flavors, sweeteners, preservatives, and colors, a trend that is evident across all major regions (11). Avoidance of added sugars is also on the rise in the wake of recent recommendations issued by the World Health Organization and the U.S. Department of Agriculture to limit daily consumption of added sugars (5,9). From a manufacturer’s perspective, acknowledgment of global shifts away from certain ingredients or components is imperative for the market success of innovative grain-based products.

Beyond the established evidence-based health benefits of certain foods and food groups, consumers also believe certain foods are “clean,” “better-for-you” choices. Global growth in the organic food and beverage markets is fueled in part by increasing consumer belief that organic items are more healthful and environmentally friendly than their conventional counterparts (13). Based on this insight, demand for organic whole grains and whole grain products is likely to continue to increase in coming years.

Plant-Based Foods and the Quest for Protein

According to research conducted by the Healthy Marketing Team, a Swedish nutrition and wellness consultancy, the notion of “plant supremacy” represents “the intersection of many trends and shifting global ideologies” and is having a significant effect on consumer food choices (4). The motivation for adopting plant-based eating patterns is multifactorial and ranges from concerns about the impact of animal agriculture on the environment to depletion of natural resources, humane treatment of animals, and effects of eating patterns on human health (4). There is an abundance of research on plant-based diets supporting their benefits for physical health. The recently released EAT-Lancet Commission report (2) has brought fresh insights to the forefront as scientific researchers affirmed that “a diet rich in plant-based foods and with fewer animal-source foods confers both improved health and environmental benefits.” Increasing dialogue on sustainability also is affecting consumer behavior. Peter Wennström, founder of Healthy Marketing Team, in e-mail correspondence with the authors, remarked “For the early adopter consumers, sustainability is a motivation to buy and for the mass-market consumer it becomes a permission to buy—a feel-good factor.”

Protein is a nutrient that has experienced an increase in popularity among the general public, and global demand for protein from sustainable sources is on the rise, according to FoodNavigator.com (1). Consumers who are shifting their food choices toward more plant-based diets (whether as true vegetarians or as “flexitarians”—people whose primary diet is vegetarian, but who occasionally include animal protein) while ensuring they are consuming sufficient quantities of protein are creating new opportunities for cereals and grains, which naturally contain proteins. As the markets for dairy and meat alternatives are flooded with plant-based innovations, grains rank high among their primary ingredients. Grain-based beverages from companies such as Oatly, Pacific Foods, and Dream Blends, and popular grain-based meat substitutes, such as Field Roast Grain Meat Company’s artisan vegan grain-based meat products and Impossible Foods’ Impossible Burger, demonstrate that novel uses for cereals and grains can cater to consumer demands for more plant-based food and beverage options. Although the protein in these offerings has not always been comparable to traditional sources, food companies are developing products that are increasingly similar to animal-derived products in content and quality. In the convenience food segment of the market, breakfast and snack bars are evolving in response to the demand for products with quality plant-based proteins, simple ingredients, and robust nutritional profiles (6).

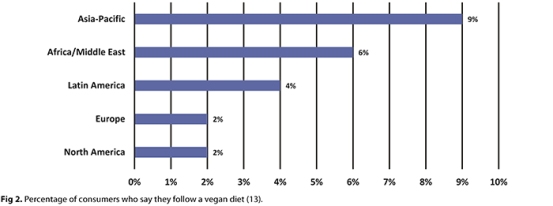

At the most extreme end of plant-based dietary patterns, veganism continues to gain in popularity, although it is still espoused by only a very small share of the global population (Fig. 2) (13). Veganism has been cited by Euromonitor International (5) as “the biggest lifestyle movement of the 21st century.” This trend presents an opportunity for value-added grain products to fill nutritional gaps.

The Rise of Free-From Diets

With nearly two-thirds of the global population following some type of special diet (12), the food industry is responding by increasing the availability of free-from foods. Mordor Intelligence expects the global free-from market to grow at a compound annual growth rate (CAGR) of nearly 5% from 2018 through 2023, with gluten-free and lactose-free products dominating the market, along with an increase in allergen-free food options that meet consumer demands in countries that do not have as many offerings for individuals following medically restricted diets (10).

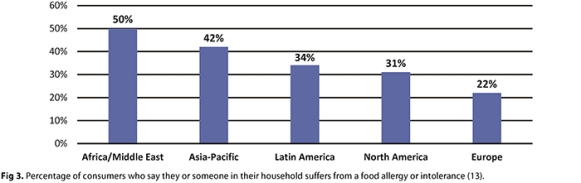

Consumers seek out free-from foods for a variety of reasons, including medical necessity due to food allergies: developed Western countries have a prevalence of up to 10%, and the prevalence in developing countries is not far behind (8). According to a Nielsen report (13), 36% of consumers globally say someone in their household suffers from a food allergy or intolerance (Fig. 3). In parallel with increased understanding, recognition, and diagnosis of celiac disease and the often subjectively diagnosed gluten intolerance, the number of consumers who believe gluten-free living is a more healthful choice has grown. Indeed, lifestyle choices, in general, are the major driving force behind the growth of the free-from trend, with a popular belief that free-from foods are healthier and more sustainable (7). Furthermore, with the incidence of chronic noncommunicable diseases continuing to rise and expected to account for 74% of global deaths by 2030, consumers are becoming more proactive in seeking dietary changes to improve their health and mitigate the risk of developing lifestyle-related conditions (13).

The free-from trend will continue to benefit naturally gluten-free ancient grains, such as millet, amaranth, buckwheat, and teff, purchased both as ingredients and as components of manufactured food products (10). Meanwhile, interest in and consumption of gluten-containing cereals and grains will be negatively impacted by the continued expansion of gluten-free alternatives in categories such as pasta, bread, and other baked goods. Popular diets designed based on negative beliefs about carbohydrates are still a factor that can disrupt the cereal and grain product market. New eating patterns continue to emerge that are based on eliminating grains altogether, reducing them significantly, or limiting their intake to certain types to purportedly benefit health and promote weight management.

Conclusions

Growing consumer sentiments concerning more health-promoting lifestyles is spawning a wave of related trends that signal potential increased consumption of cereals and grains. Whole grains are naturally nutrient-rich and versatile foods that fit well within current movements toward diets centered on closer-to-nature, plant-based food choices. Moreover, as more consumers consider sustainability when making dietary choices, it is likely that grains will be viewed positively in light of their minimal environmental impact compared with other food groups. Grains and grain-based products also satisfy consumers with specific dietary needs or preferences for certain free-from foods. However, an increasing population of individuals suffering from celiac disease or self-diagnosed gluten intolerance, along with consumers who have negative perceptions of gluten unrelated to disease or allergy, will continue to avoid gluten-containing grains. On the whole, the current landscape of health and nutrition trends appears quite favorable for cereals and grains.

Conflicts of Interest

The authors are employed by Eat Well Global, Inc., a nutrition communications consultancy, whose clients include global food manufacturers and commodity boards. Eat Well Global, Inc. has a strategic partnership agreement with Healthy Marketing Team, whose clients include international food, beverage, supplement, and food ingredient companies.

Vanessa Costa, MS, RDN, is a registered dietitian nutritionist and communications professional at Eat Well Global, a consultancy working at the intersection of food, sustainable nutrition, and global health. With significant experience in nutrition communication and strategy, Vanessa leads operations work at Eat Well Global and manages projects on behalf of the company’s clients, which include multinational food companies, commodity boards, and non-governmental organizations. Her past experience includes working as an in-house dietitian and nutrition strategist at a leading snack food company and providing nutrition counseling services to private clients in New York City.

Vanessa Costa, MS, RDN, is a registered dietitian nutritionist and communications professional at Eat Well Global, a consultancy working at the intersection of food, sustainable nutrition, and global health. With significant experience in nutrition communication and strategy, Vanessa leads operations work at Eat Well Global and manages projects on behalf of the company’s clients, which include multinational food companies, commodity boards, and non-governmental organizations. Her past experience includes working as an in-house dietitian and nutrition strategist at a leading snack food company and providing nutrition counseling services to private clients in New York City.

Andrea Johnson, RD, CSP, LDN, is a nutrition communications consultant at Eat Well Global, a communications and consulting firm whose mission is to empower global change agents in the food and nutrition industry. Over the past 15 years in practice as a registered dietitian, in addition to providing education and counseling to clients in clinical and corporate settings, she has consulted, lectured, written, mentored, participated in research, and served on advisory boards through various community, academic, and business venues in general and specialized fields of nutrition.

Andrea Johnson, RD, CSP, LDN, is a nutrition communications consultant at Eat Well Global, a communications and consulting firm whose mission is to empower global change agents in the food and nutrition industry. Over the past 15 years in practice as a registered dietitian, in addition to providing education and counseling to clients in clinical and corporate settings, she has consulted, lectured, written, mentored, participated in research, and served on advisory boards through various community, academic, and business venues in general and specialized fields of nutrition.